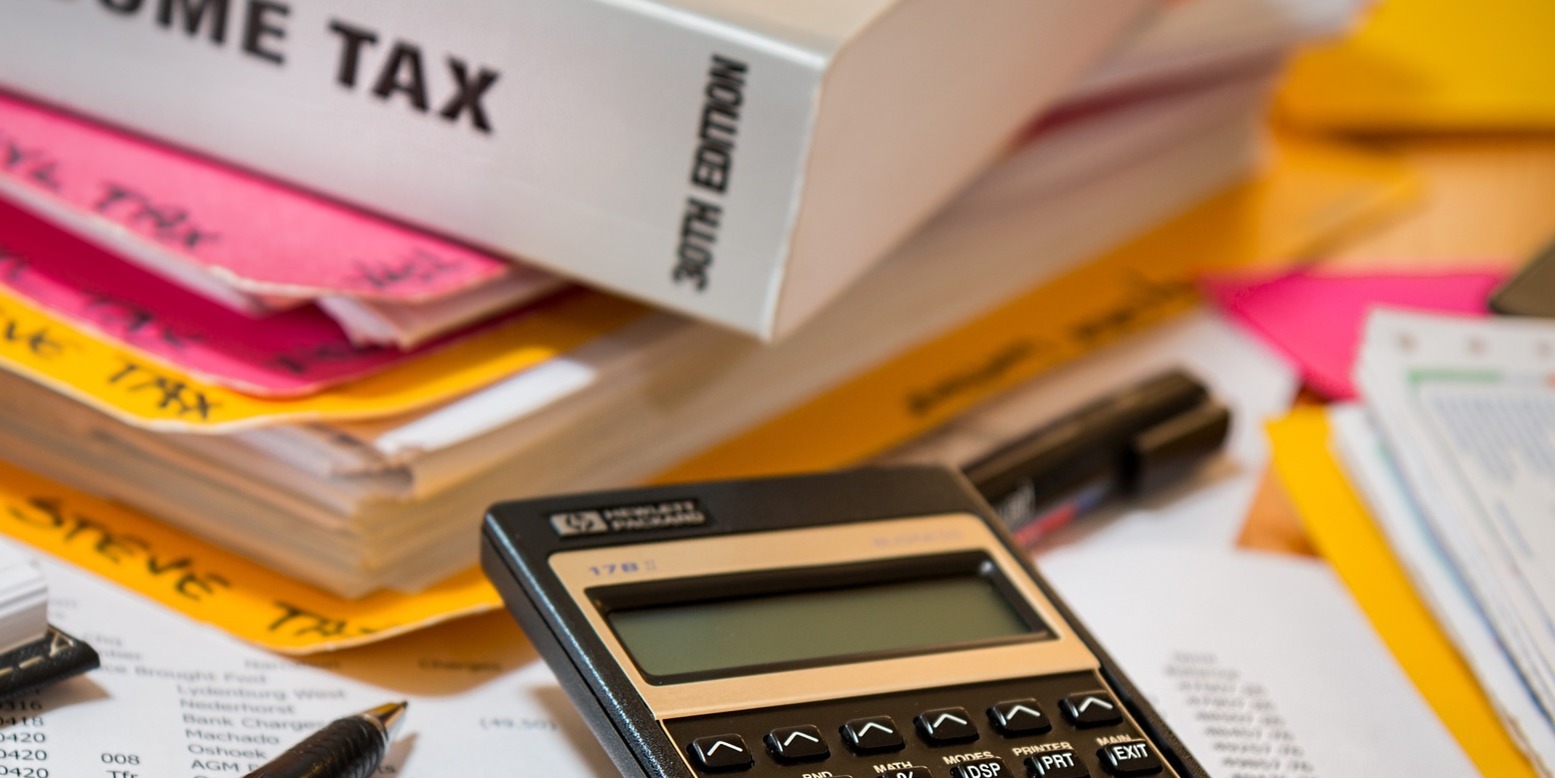

Navigating Tax Changes: What you need to know for 2024/25

Posted on 30th April 2024

As we embark on a new tax year, individuals and businesses alike need to stay informed about the latest tax updates and changes that may impact their financial planning. The tax landscape is ever-evolving, with new regulations and updates introduced each year. In this and forthcoming blog posts, we'll explore the key tax changes for the 2024/25 tax year and what they mean for taxpayers.

Personal Allowance and Tax Bands (England & Wales)

The personal allowance for 2024/25 remains unchanged at £12,570, this is the amount you can earn without paying any income tax. If you earn more than your personal allowance, you pay tax at the applicable rate on all earnings above the personal allowance. These rates are currently:

Under £12,570 No tax payable

Between £12,570 & £37,700 20%

Between £37,701 & £125,140 40%

Over £125,140 (additional rate) 45%

National Insurance Contributions

In addition to income tax, most workers will also have to pay National Insurance contributions. These kick in based on your earnings from the age of 16 and you usually stop paying when you reach state pension age. The current NI rates you will pay are:

Weekly Salary Rate

Less than £242 Less than £12,570 0%

£242 - £967 £12,570 to £50,270 8%

Over £967 Over £50,270 8% on everything earned between £242 to £967 a week, 2% on everything above that

If you are employed, class 1 NI will be collected through your usual payslip at the relevant level.

If you’re self-employed, class 4 NI contributions will be automatically calculated on your tax return.

Share this post: